To read a check, simply examine the information printed on it, including the date, payee, amount, and signature. Look for any discrepancies or errors that may require your attention.

Reading a check involves reviewing the relevant details to ensure accuracy and legitimacy. Checks serve as a common form of payment and understanding how to read them is essential for financial management. By carefully examining the information on a check, you can verify its validity and ensure that it aligns with your expectations.

Credit: www.gobankingrates.com

Decoding The Front Of A Check

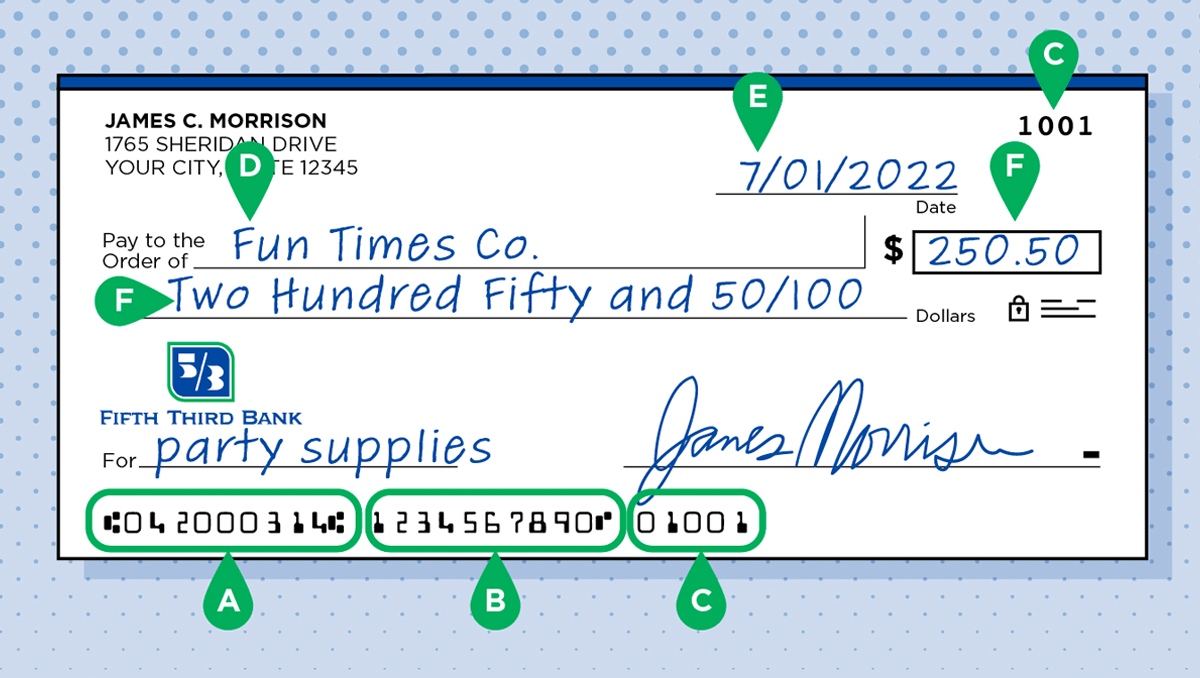

When it comes to understanding the front of a check, it’s essential to know how to decode the various elements. From personal information to the signature line, each section holds important details that are crucial for accurately processing the check.

Personal Information

The top-left corner of a check typically contains personal information such as the account holder’s name, address, and sometimes phone number. This provides identification and contact details for the account holder.

Check Number

The check number is usually located at the top-right corner of the check. It’s a unique identifier for each check issued by the account holder and is used for tracking and record-keeping purposes.

Date Line

Beneath the personal information, you will find the date line. This is where the date the check was written is recorded. It’s crucial for determining the validity and timing of the transaction.

Payee Line

Below the date line, the payee line specifies who the check is written to. It’s important to ensure the accuracy of the payee’s name to prevent any potential issues with depositing or cashing the check.

Amount Box

On the right-hand side of the check, the amount box displays the monetary value of the check in a numerical format. This section is vital for clarity and precision in the amount being paid.

Amount Line

Directly below the amount box, the amount line represents the written form of the payment amount. This serves as a backup to the numerical figure, helping to avoid any discrepancies in the amount being paid.

Memo Line

The memo line provides an opportunity to include additional information about the purpose of the payment. While not mandatory, it can be helpful for both the payer and payee to track the reason for the transaction.

Signature Line

At the bottom-right corner of the check, the signature line is where the account holder signs, authorizing the payment. This signature is a crucial security feature and ensures that the check is valid and authorized by the account holder.

Understanding The Back Of A Check

When it comes to handling a check, it’s essential to understand the different parts of it. The back of a check is just as important as the front, as it contains crucial information that affects the payment process. In this article, we’ll discuss how to read the back of a check and what each section means.

Endorsement Area

The endorsement area on the back of a check is where the payee signs to endorse the check. This area is typically located on the top portion of the back of the check and can include additional lines to allow for multiple endorsements. Endorsing a check is necessary to transfer the payment to another party, such as a bank or another individual. It’s important to sign the check on the endorsement line exactly as it’s written on the front of the check. Failure to do so could result in the check being rejected by the bank.

Bank’s Use Area

The Bank’s Use Area is the section on the back of a check that is reserved for the bank to use. This area includes lines for the bank to record the deposit transaction, the date of deposit, and any fees associated with the transaction. The bank may also include additional information, such as the account number and the bank’s routing number. It’s important to note that this section is for the bank’s use only and should not be written on by the account holder.

Security Features

Checks have a variety of security features to prevent fraudulent activity. These features include watermarks, microprint, and security screens that prevent alterations or erasures. It’s essential to examine the check carefully and look for these security features to ensure that the check is valid. If you receive a check that appears suspicious or lacks security features, it’s best to contact the issuing bank to verify the check’s authenticity.

In Conclusion, understanding the back of a check is crucial for ensuring that the payment process goes smoothly. By knowing what each section means, you can avoid errors and prevent fraudulent activity. Always examine the check carefully and look for security features before accepting it as payment.

The Micr Line Breakdown

When reading a check, understanding the MICR line breakdown is crucial. The MICR line contains the bank routing number, account number, and check number, allowing for accurate processing of payments. Familiarizing yourself with this information ensures proper handling of financial transactions.

Routing Number

The routing number identifies the bank. The first nine digits on the MICR line. Used for electronic and paper transactions.

Account Number

Directly linked to your bank account. Follows the routing number on the MICR line. Essential for accurate fund transfers.

Check Number Revisited

Indicates the specific check’s sequence. Located at the end of the MICR line. Helps in tracking and record-keeping. The MICR Line Breakdown: The Magnetic Ink Character Recognition (MICR) line on a check is crucial for processing payments accurately. It contains information that is vital for financial transactions, including the routing number, account number, and check number. Let’s delve deeper into these components.

Common Symbols And Their Meanings

How to Read a Check? Understanding the various symbols is essential. These symbols provide important information about the check and its processing. In this section, we will explore the meanings of some common symbols found on a check.

Dollar Sign

The dollar sign ($) is a universal symbol for currency, representing the United States dollar. It is placed before the numerical amount to indicate the monetary value of the check. For example, $100 represents one hundred dollars.

Fractional Format

The fractional format on a check is used to represent a specific dollar amount. It consists of two parts: the numerator and the denominator. The numerator indicates the whole dollar amount, while the denominator represents the fraction of a dollar. For instance, 75/100 represents seventy-five cents.

Abb Routing Symbol

The ABB Routing Symbol, also known as the American Banking Association routing number, is a unique nine-digit code. It identifies the financial institution responsible for processing the check. This number is crucial for electronic transfers and ensures that the funds reach the correct bank.

On-us Symbol

The On-Us symbol is a special symbol used to indicate that the check can be cashed by the bank on which it is drawn. This symbol is typically located at the bottom of the check and is essential for the bank’s internal processing.

Understanding these common symbols on a check will help you navigate the world of financial transactions with ease. Whether it’s identifying the dollar amount, deciphering the routing number, or recognizing the On-Us symbol, these symbols provide valuable information about the check and its processing.

Tips For Writing Checks

Writing a check may seem like a simple task, but it’s important to ensure that you do it correctly to avoid any issues with your finances. Here are some essential tips to keep in mind when writing checks:

Filling Out Checks Correctly

- Use a pen with indelible ink to fill out your check.

- Write the current date on the date line in the top right corner.

- Enter the recipient’s name on the “Pay to the order of” line.

- Write the payment amount in numbers in the box provided.

- Express the payment amount in words on the line below the recipient’s name.

- Sign your check at the bottom right corner using your full legal name.

Avoiding Common Mistakes

- Avoid leaving blank spaces on the check.

- Double-check the amount in words for accuracy.

- Do not use abbreviations for the recipient’s name or payment amount.

- Never post-date a check as it can lead to uncertain funds.

Security Tips

Protecting the security of your checks is crucial. Follow these security tips to safeguard your financial information:

- Store your blank checks in a secure location to prevent unauthorized access.

- Keep track of your checkbook and monitor your transactions regularly.

- Consider using gel pens to prevent check alteration.

- Reconcile your bank statements to detect any unauthorized transactions.

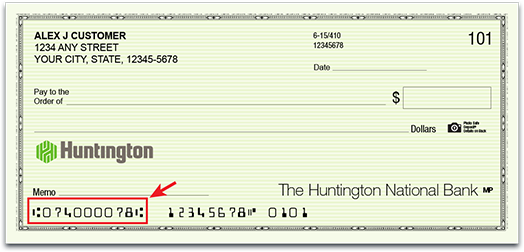

Credit: www.huntington.com

Electronic Checks And How They Differ

Electronic checks, also known as e-checks, are a digital form of traditional paper checks. They offer a convenient and secure way to make payments online. Understanding how e-checks work and how they differ from traditional checks is essential for anyone who frequently deals with electronic transactions. In this section, we will dive into the details of e-checks, explaining what they are and how to read the information they contain.

E-checks Explained

E-checks are essentially electronic versions of paper checks. Instead of physically writing and mailing a check, e-checks allow individuals and businesses to send payments digitally. This method offers several advantages, including faster processing times and reduced costs compared to traditional paper checks.

When it comes to e-checks, the payment information is transmitted electronically, and the recipient can deposit the funds directly into their bank account. This eliminates the need for manual processing and reduces the risk of lost or stolen checks. Additionally, e-checks can be easily tracked and recorded for future reference.

Reading Electronic Check Information

Reading the information on an e-check is similar to reading a traditional check, with a few key differences. Here’s what you need to know:

- Payee: The payee is the individual or business who will receive the payment. Make sure the payee name matches the intended recipient.

- Payer: The payer is the person or organization making the payment. Verify that the payer’s information is accurate.

- Amount: The amount field indicates the total payment amount. Double-check that the amount is correct to avoid any discrepancies.

- Date: The date field shows the date the e-check was initiated. Confirm that the date aligns with the payment timeline.

- Bank Account Information: E-checks typically include the bank account number and routing number associated with the payer’s account. This information is crucial for processing the payment correctly.

By carefully reviewing these key elements, you can ensure that the e-check information is accurate and reliable. This will help prevent any potential issues or errors with the payment process.

Practical Exercises For Check Reading

Let’s delve into practical exercises for enhancing your check reading skills.

Sample Check Analysis

Examine a sample check to identify key components.

Self-test Scenarios

Create scenarios to test your check reading proficiency.

When And How To Use A Check

Appropriate Situations For Checks

Checks are suitable for paying bills and making large purchases.

- When paying rent or mortgage

- For services like plumbing or electrical work

- When buying expensive items like furniture or electronics

Alternatives To Checks

Other payment methods include:

- Electronic transfers

- Online payment platforms like PayPal

- Using credit or debit cards

Credit: www.53.com

Frequently Asked Questions

What Information Is On A Check?

A check typically includes the date, payee’s name, amount in words and figures, payer’s signature, and bank details. It serves as an instruction to the bank to pay a specific amount from the payer’s account to the payee.

How Do I Endorse A Check?

To endorse a check, sign your name on the back. If it’s for deposit only, specify “For deposit only” and include the account number. For transferring to another person, add “Pay to the order of [recipient’s name]” and then sign.

Where Can I Cash A Check?

You can cash a check at your bank, the issuing bank, or retail locations such as supermarkets or check-cashing stores. Some banks also offer mobile check deposit through their banking apps for added convenience.

Conclusion

To sum up, reading a check may seem like a simple task, but it requires attention to detail and a clear understanding of the different sections. By following the guidelines discussed in this post, you can ensure that you read checks accurately and avoid any potential mistakes.

Remember to always double-check the information on the check and contact your bank if you have any questions or concerns. With practice, reading checks will become second nature, and you’ll be able to handle your finances with confidence.