To borrow money from Cash App, you can use the Cash App’s “Cash Advance” feature. This feature allows you to borrow money up to a set limit.

In today’s fast-paced world, financial needs can arise unexpectedly. When faced with such situations, having access to quick and convenient borrowing options can be a lifesaver. Cash App, a popular mobile payment service, offers a seamless way to borrow money through its “Cash Advance” feature.

Whether you need funds for an emergency or to cover unexpected expenses, understanding how to leverage this option can provide financial flexibility. We’ll explore the steps to borrow money from Cash App, the associated terms and conditions, and tips for responsible borrowing. By the end, you’ll be equipped with the knowledge to make informed decisions when utilizing this convenient financial tool.

Introduction To Cash App Borrow Feature

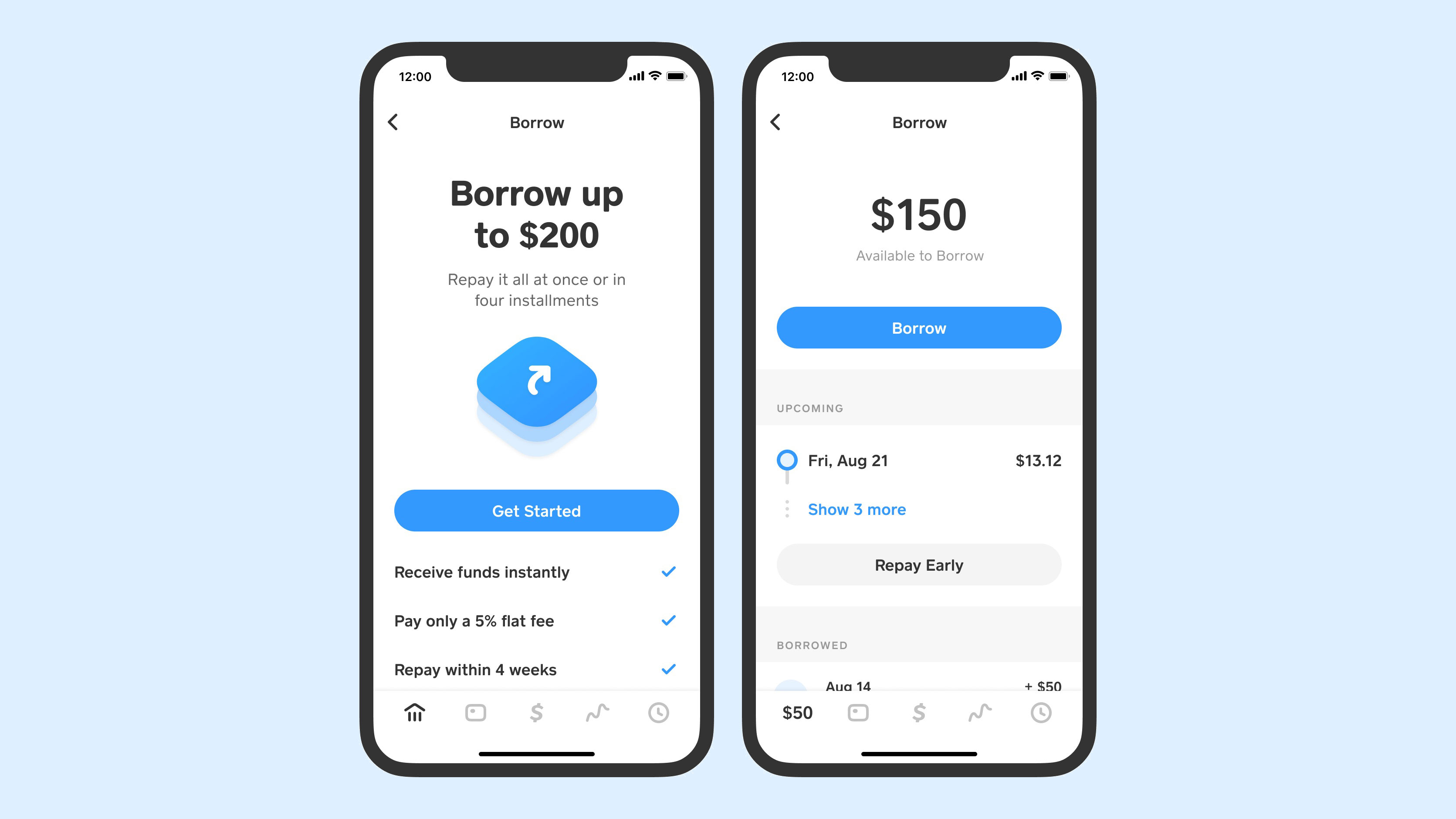

Cash App introduces a new feature allowing users to easily borrow money within the app. To access this service, users can simply navigate to the Cash App Borrow section and follow the prompts to secure a loan directly through the platform.

What Is Cash App?

Cash App is a mobile payment service that allows users to send and receive money from their friends and family. With the app, users can link their bank account, debit card or credit card to their Cash App account, making it easy to make transactions. The app also offers other features such as buying and selling Bitcoin, investing in stocks and even cashback rewards for using the app.

The Emergence Of The Borrow Feature

Cash App has recently introduced a new feature called Cash App Borrow, which allows users to borrow money from the app. This feature is aimed at users who need quick cash for emergencies or unexpected expenses. With Cash App Borrow, users can borrow amounts ranging from $20 to $200 at a time. The borrowed amount is then deducted from the user’s next deposit into their Cash App account. Cash App Borrow is a simple and convenient way to get quick cash when you need it. The feature is easy to use and can be accessed through the app.

Users can apply for a loan by selecting the Cash App Borrow option in the app, and then following the instructions. Once approved, the borrowed amount will be added to the user’s Cash App balance, which can be used to make purchases or send money to other users. To qualify for a Cash App Borrow loan, users must have a valid Cash App account and a history of making regular deposits into their account. The loan amount is determined by the user’s account history and other factors, such as credit score. The loan must be paid back within four weeks, or the user may incur additional fees and penalties.

In conclusion, Cash App Borrow is a useful feature for users who need quick cash for emergencies or unexpected expenses. The feature is easy to use and can be accessed through the app. However, users should be aware of the terms and conditions of the loan, and should only borrow what they can afford to pay back.

Eligibility Criteria For Borrowing

Before you can borrow money from Cash App, there are certain eligibility criteria that you need to meet. These criteria ensure that you are a responsible borrower and capable of repaying the borrowed amount. Here are the key factors that determine your eligibility:

User Requirements

In order to be eligible for borrowing money from Cash App, you need to meet the following user requirements:

- Your age must be at least 18 years old.

- You must have a verified Cash App account.

- You need to have a consistent source of income to demonstrate your ability to repay the borrowed amount.

- Your Cash App account must be in good standing with no history of fraudulent activities or violations of Cash App’s terms of service.

Account Limitations

In addition to user requirements, there are certain account limitations that you should be aware of when borrowing money from Cash App:

- Cash App sets a borrowing limit based on various factors such as your transaction history, income, and creditworthiness.

- The borrowing limit may vary from user to user and can be adjusted by Cash App based on your repayment behavior and overall financial profile.

- It is important to note that exceeding your borrowing limit or failing to repay the borrowed amount on time may result in additional fees and penalties.

By fulfilling the user requirements and understanding the account limitations, you can determine if you are eligible to borrow money from Cash App. It is crucial to borrow responsibly and only take out loans that you can comfortably repay to avoid any financial difficulties in the future.

Setting Up Your Cash App

Before borrowing money from Cash App, you need to set up your account. The process is simple and straightforward. Here are the steps to follow:

Verifying Your Identity

The first step to setting up your Cash App account is to verify your identity. This is a necessary step to ensure that your account is secure and to prevent fraud. To verify your identity, follow these steps:

- Open the Cash App on your mobile device.

- Click on the profile icon on the home screen.

- Select “Personal” and then enter your legal name and date of birth.

- Enter your social security number.

- Take a photo of your government-issued ID (driver’s license, passport, or state ID).

- Submit your ID for verification.

Ensuring Account Health

After verifying your identity, it’s important to ensure that your Cash App account is healthy. This means that you have linked a valid debit card and that your account is in good standing. Follow these steps to ensure your account is healthy:

- Link a valid debit card to your Cash App account. This will allow you to borrow money from Cash App.

- Ensure that your account is in good standing. If there are any issues, such as a negative balance or a dispute, you will not be able to borrow money.

- Check that your Cash App account is up to date. Make sure that your email address and phone number are correct, as this is how Cash App will communicate with you.

Once you have completed these steps, you are ready to start borrowing money from Cash App. Keep in mind that there are limits to how much you can borrow, and you will need to pay back the loan with interest. However, Cash App can be a convenient way to get money quickly when you need it.

Navigating To The Borrow Option

Navigating to the Borrow Option on Cash App is a straightforward process that allows you to access quick funds when needed. To get started, open the Cash App and locate the “Borrow” tab. From there, you can explore your borrowing options and understand your borrowing limit.

Finding The Borrow Tab

To find the Borrow tab on Cash App, simply open the app and look for the “Borrow” option on the main navigation menu. Once located, tap on the “Borrow” tab to begin the borrowing process.

Understanding Your Borrow Limit

When using the Borrow feature on Cash App, it’s essential to understand your borrowing limit. This limit is determined based on various factors, including your account history, transaction frequency, and other relevant financial details. Knowing your borrowing limit can help you make informed decisions when accessing funds through Cash App.

Step-by-step Guide To Borrow Money

Learn how to borrow money from Cash App with this step-by-step guide. Discover the process and guidelines to ensure a smooth transaction and access the funds you need quickly and conveniently. Get started on your borrowing journey today!

Step 1: Requesting The Loan

To borrow money from Cash App, you’ll first need to request a loan through the app. Follow these simple steps:

- Open the Cash App on your mobile device and log in to your account.

- Tap on the “My Cash” tab located at the bottom-center of the screen.

- Select the “Borrowing” option.

- Enter the amount of money you wish to borrow.

- Review the terms and conditions associated with the loan.

- If you agree to the terms, tap on the “Request Loan” button.

By following these steps, you will successfully request a loan through Cash App.

Step 2: Accepting The Loan Terms

After requesting a loan, you will need to accept the loan terms in order to proceed. Here’s what you need to do:

- Check your email or Cash App notifications for the loan offer.

- Open the email or notification and carefully read through the loan terms.

- If you agree to the terms, tap on the provided link to accept the loan.

- Confirm your acceptance by entering any required information, such as your signature or personal details.

Following these steps will allow you to accept the loan terms and proceed with the borrowing process on Cash App.

Credit: www.wikihow.com

Repayment Terms And Conditions

Borrowing money from Cash App is easy with clear repayment terms and conditions. The process is simple, allowing users to access the funds they need quickly and conveniently.

Repayment Schedule

When borrowing money from Cash App, it is important to understand the repayment schedule. The repayment schedule outlines the timeframe within which you need to repay the borrowed amount. This schedule is typically agreed upon at the time of borrowing and is based on the terms and conditions set by Cash App.

The repayment schedule can vary depending on the amount borrowed and the specific terms of your loan. It is important to carefully review and understand the repayment schedule before accepting the loan offer. This will help you plan your finances and ensure timely repayment.

Interest Rates And Fees

Interest rates and fees play a crucial role in the repayment terms and conditions of borrowing money from Cash App. Interest rates are the additional amount you need to pay on top of the borrowed sum. The rate is usually expressed as an annual percentage and may vary depending on factors such as your creditworthiness and the amount borrowed.

Fees, on the other hand, are charges levied by Cash App for processing the loan or any other related services. These fees can include origination fees, late payment fees, or early repayment fees. It is important to carefully review the interest rates and fees associated with your loan to understand the total cost of borrowing.

Understanding the interest rates and fees will help you make an informed decision about borrowing from Cash App. It is essential to consider these costs when determining if the loan is affordable and fits within your budget.

Tips For A Smooth Borrowing Experience

To ensure a smooth borrowing experience on Cash App, start by verifying your account and linking a valid payment method. Review the terms and conditions carefully before requesting the desired amount. Keep track of repayment dates to avoid any potential issues.

Maintaining A Healthy Balance

Keeping a healthy balance in your Cash App account is key to smooth borrowing.

Regularly monitor your account to avoid overdrafts.

- Check your balance daily

- Set up balance alerts

Repaying On Time

Timely repayment builds trust and improves your credit.

Set reminders to ensure on-time payments.

- Use auto-pay features

- Mark due dates on a calendar

Credit: m.youtube.com

Troubleshooting Common Issues

Encountering issues while borrowing money from Cash App is common. Below are the common problems users face:

Loan Application Declined

- Insufficient funds in your Cash App account.

- Low credit score or incomplete personal information.

Problems With Repayment

- Forgotten repayment schedule.

- Technical glitches during the repayment process.

Alternatives To Cash App Borrowing

When considering borrowing money, it’s essential to explore alternatives to Cash App. Here are some options to explore:

Other Loan Apps

Explore alternative loan apps for different borrowing options.

Traditional Lending Options

Consider traditional banks and credit unions for conventional borrowing solutions.

Credit: techcrunch.com

Frequently Asked Questions

How Can I Borrow Money From Cash App Securely?

To borrow money from Cash App securely, ensure your account is verified, only borrow from trusted contacts, and use the app’s security features like passcode and touch ID.

What Are The Fees For Borrowing Money On Cash App?

Cash App charges a flat fee of 5% on the total borrowed amount. Ensure to review and understand the fee structure before borrowing to avoid any surprises.

Is There A Limit On How Much Money I Can Borrow From Cash App?

Yes, Cash App has a borrowing limit based on various factors like account history and usage. Check your app or contact customer support for details on your specific limit.

Conclusion

Borrowing money from Cash App can be a convenient option for quick financial assistance. By following the simple steps and being mindful of the terms and conditions, users can access the funds they need. Understanding the process and its implications can help individuals make informed decisions about their finances.