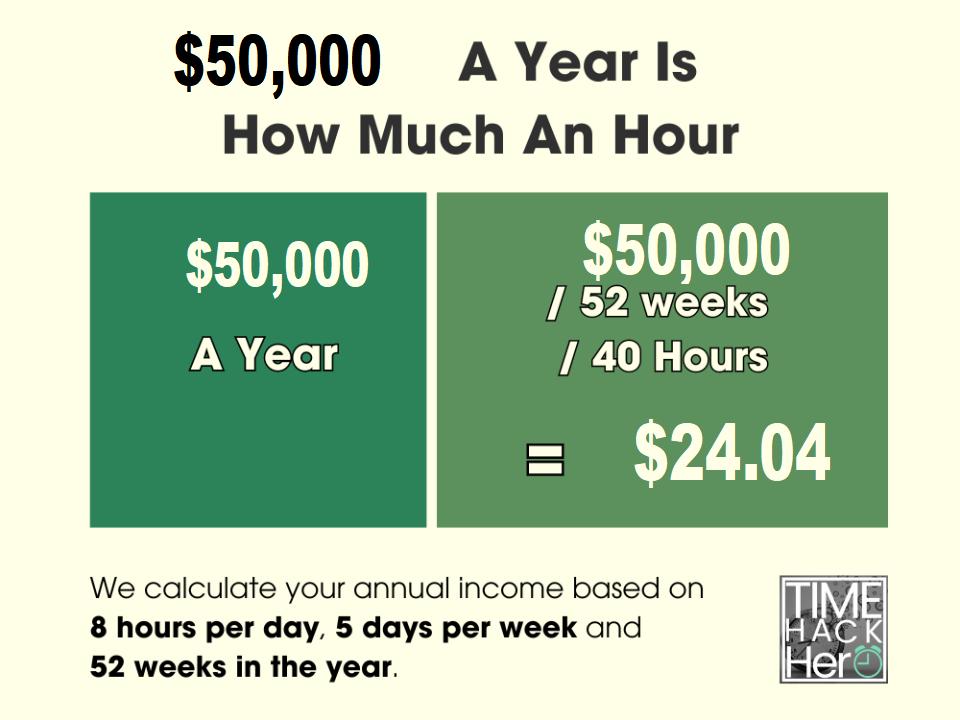

The hourly rate for a $50,000 annual salary is approximately $24 per hour. This calculation is based on a standard 40-hour workweek.

Earning a $50,000 yearly salary translates to an hourly rate of around $24. This figure is derived from the standard 40-hour workweek. Understanding the equivalent hourly wage for an annual income can provide valuable insight into one’s earning potential and financial planning.

Whether evaluating job offers, considering career changes, or simply managing personal finances, knowing the hourly rate for a given annual salary is a practical and informative metric. By delving into this topic, individuals can gain a clearer understanding of their income and how it aligns with their lifestyle and financial goals.

Credit: www.howtofire.com

Breaking Down Annual Salaries

Understanding your annual salary is an essential part of managing your finances. However, it can be confusing when you are trying to determine how much you make per hour, especially if you work a salaried job. It’s essential to know your hourly rate to ensure you are earning what you deserve.

From Yearly To Monthly Pay

One way to break down your annual salary is to convert it to a monthly pay rate. To do this, divide your annual salary by 12. For example, if you make $50,000 a year, your monthly pay would be $4,166.67.

Weekly Wage Calculations

If you want to know your hourly rate, you need to break down your salary even further into weekly pay. To do this, divide your monthly pay by 4.33 (the average number of weeks in a month). For example, if you make $4,166.67 a month, your weekly pay would be $961.54.

Finally, to determine your hourly rate, divide your weekly pay by the number of hours you work each week. If you work 40 hours a week, your hourly rate would be $24.04 (rounding to the nearest cent).

Breaking down your annual salary into hourly pay can help you better understand your income and ensure you are earning what you deserve. By following the steps above, you can easily calculate your hourly rate and make informed decisions about your finances.

50k Yearly: The Hourly Perspective

When it comes to understanding your annual salary in terms of an hourly rate, it can be helpful to break it down into smaller increments. This allows you to better grasp the value of your time and make informed decisions about your finances. In this article, we will explore the hourly perspective of a $50,000 yearly salary and provide you with a framework to calculate your hourly rate.

Standard Work Hours Framework

Before diving into the calculations, it’s important to establish the standard work hours framework. In most cases, a full-time employee works an average of 40 hours per week. This equates to 2,080 hours per year, assuming a consistent schedule throughout the year. Keep in mind that this framework may vary depending on your specific employment terms.

Calculating Hourly Rate From Annual Salary

To determine your hourly rate from a $50,000 annual salary, you can use a simple formula. Divide your annual salary by the number of standard work hours in a year:

Hourly Rate = Annual Salary / Standard Work Hours

Let’s apply this formula to our example:

| Annual Salary | Standard Work Hours | Hourly Rate |

|---|---|---|

| $50,000 | 2,080 | $24.04 |

According to the calculations, a $50,000 annual salary translates to an hourly rate of approximately $24.04. This means that for every hour you work, you are effectively earning around $24.04.

Keep in mind that this calculation provides a rough estimate and does not account for factors such as overtime, bonuses, or deductions. Your actual hourly rate may vary depending on these additional factors.

Understanding the hourly perspective of your annual salary can be beneficial when budgeting, negotiating job offers, or evaluating potential income opportunities. By breaking down your earnings into smaller increments, you gain a clearer understanding of the value of your time and can make more informed financial decisions.

Factors Influencing Hourly Earnings

Earning $50,000 annually equates to roughly $24 per hour, based on a standard 40-hour workweek. Factors influencing hourly earnings include skill level, experience, industry demand, and geographic location. Understanding these elements helps individuals gauge their income potential more accurately.

Factors Influencing Hourly Earnings When it comes to determining how much you can earn in a year, there are several factors to consider. One important factor is whether you are working full-time or part-time. Other factors include overtime considerations, industry, location, and level of experience. How Much is 50K a Year Hourly? Full-Time vs Part-Time Status If you are working full-time, you can expect to earn a salary of $50,000 per year. This breaks down to an hourly rate of around $24 per hour, assuming a 40-hour workweek.

However, if you are working part-time, your hourly rate may be higher to compensate for the reduced hours worked. Overtime Considerations In addition to your base hourly rate, overtime pay can significantly increase your earnings. If you are eligible for overtime pay, you can expect to earn time-and-a-half for any hours worked over 40 hours in a week. This means that your hourly rate could be as high as $36 per hour if you work overtime regularly. Industry and Location The industry and location in which you work can also impact your hourly earnings.

Some industries pay higher wages than others, and certain regions of the country also have higher wages due to a higher cost of living. For example, if you work in the tech industry in California, you can expect to earn a higher hourly rate than if you work in retail in a small town in the Midwest. Level of Experience Finally, your level of experience can also influence your hourly earnings. Entry-level positions typically pay less than positions that require more experience and expertise. However, as you gain more experience in your field, you can expect your hourly rate to increase.

In conclusion, there are several factors to consider when determining how much you can earn hourly with a $50,000 annual salary. By taking into account factors such as full-time vs part-time status, overtime considerations, industry and location, and level of experience, you can get a better idea of your potential hourly earnings.

Credit: timehackhero.com

The Role Of Taxes In Your Take-home Pay

The Role of Taxes in Your Take-Home Pay

Understanding Payroll Deductions

When you earn $50,000 a year, it’s important to understand the impact of taxes on your take-home pay. Payroll deductions, including federal and state income taxes, social security, and Medicare, directly affect the amount you receive in each paycheck. These deductions are calculated based on your annual income and filing status, with allowances for factors such as dependents and deductions.

Net Income Estimations

Estimating your net income is crucial for financial planning. By considering your gross annual salary of $50,000, along with the applicable tax rates and deductions, you can calculate an estimate of your net income. This figure provides a clearer understanding of your take-home pay and allows you to budget effectively. Additionally, consulting with a tax professional can provide valuable insights into maximizing your net income and minimizing tax liabilities.

Comparing Salaries Across Industries

When it comes to evaluating job offers or considering a career change, understanding salary benchmarks across different industries can be crucial. Knowing the average pay for a particular job can help you negotiate better compensation and make informed decisions. In this article, we will explore sector-specific salary benchmarks and location-based pay differences to give you a clearer picture of how much $50,000 a year translates into an hourly wage.

Sector-specific Salary Benchmarks

Salary benchmarks vary significantly across industries. Some sectors, such as healthcare and technology, typically offer higher salaries compared to others. Let’s take a look at some sector-specific salary benchmarks:

| Industry | Average Salary Range |

|---|---|

| Healthcare | $50,000 – $80,000 per year |

| Technology | $60,000 – $100,000 per year |

| Finance | $50,000 – $90,000 per year |

| Education | $40,000 – $60,000 per year |

These figures represent broad salary ranges and can vary based on factors such as experience, qualifications, and location.

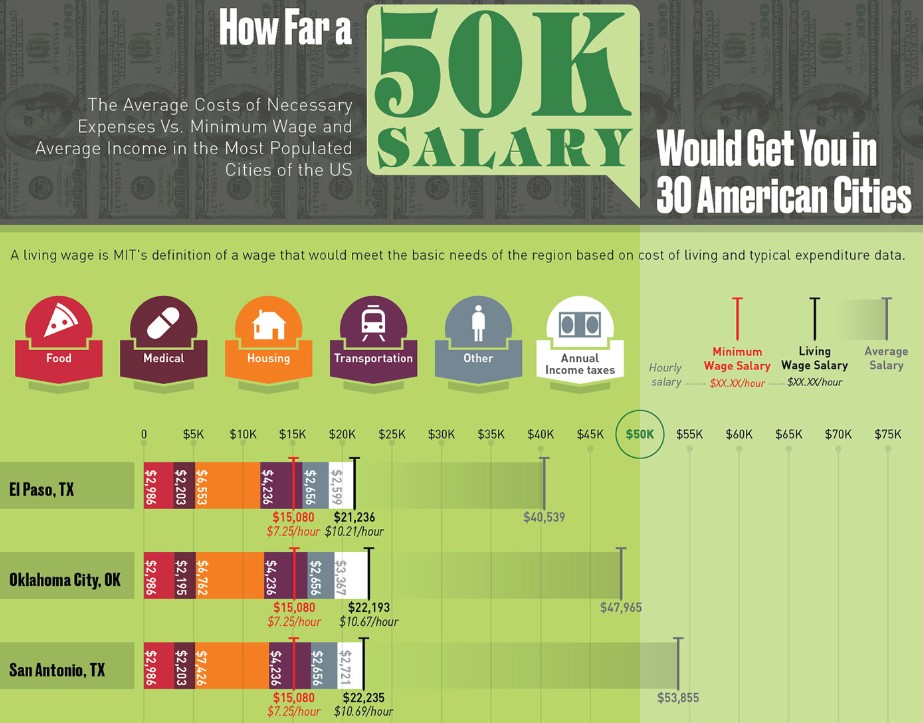

Location-based Pay Differences

Salary benchmarks can also vary depending on the location where the job is based. The cost of living and the local job market play a significant role in determining salary levels. Here are some examples of location-based pay differences:

- In cities with a higher cost of living, such as New York or San Francisco, salaries tend to be higher compared to rural areas.

- States with a strong economy, like California or Texas, often offer higher salaries.

- International locations may have different salary standards due to currency exchange rates and local economic factors.

It’s important to consider location-based pay differences when evaluating job offers or planning a career move. Researching the average salaries in your desired location can help you set realistic salary expectations.

Understanding sector-specific salary benchmarks and location-based pay differences can give you valuable insights into how much $50,000 a year translates into an hourly wage. Keep in mind that these benchmarks are just reference points, and individual circumstances may vary. It’s always advisable to conduct thorough research and consider various factors before making any decisions regarding your career and compensation.

Adjusting Lifestyle To A 50k Salary

Transitioning to a 50K salary requires making adjustments to your lifestyle and financial habits. By effectively managing your budget and implementing long-term financial planning strategies, you can make the most out of your income. In this blog post, we will explore some essential budgeting tips and discuss the importance of long-term financial planning to help you thrive on a 50K salary.

Budgeting Essentials

Creating a budget is crucial when adjusting to a 50K salary. It allows you to prioritize your expenses and track where your money is going. By following these budgeting essentials, you can make your income stretch further:

- Track your expenses: Keep a record of all your spending, including small purchases. This will give you a clear picture of where your money is being spent and help identify areas where you can cut back.

- Create categories: Divide your expenses into categories such as housing, transportation, groceries, entertainment, and savings. This will make it easier to allocate funds and determine areas where you can reduce spending.

- Set financial goals: Establish short-term and long-term financial goals to stay motivated and focused. Whether it’s saving for a vacation or paying off debt, having specific targets will help you make informed decisions.

- Reduce unnecessary expenses: Identify non-essential expenses that can be minimized or eliminated. Consider cutting back on dining out, subscription services, and impulse purchases to free up more funds for savings or debt repayment.

- Automate savings: Set up automatic transfers to a savings account to ensure you consistently save a portion of your income. This will help you build an emergency fund and work towards achieving your long-term financial goals.

Long-term Financial Planning

While budgeting is crucial for managing your day-to-day expenses, long-term financial planning is equally important for securing your future. Here are some key strategies to consider:

- Invest in retirement: Start contributing to a retirement account, such as a 401(k) or an Individual Retirement Account (IRA). Take advantage of any employer matching contributions and ensure your retirement savings grow over time.

- Build an emergency fund: Set aside a portion of your income each month for unexpected expenses. Aim to save at least three to six months’ worth of living expenses to provide a safety net in case of job loss or unforeseen circumstances.

- Pay off debt: Prioritize paying off high-interest debt, such as credit cards or personal loans. Make more than the minimum payments whenever possible to reduce the overall interest paid and accelerate your debt repayment.

- Invest wisely: Consider investing in low-cost index funds or diversified portfolios to grow your wealth over time. Research different investment options and consult with a financial advisor to make informed decisions.

- Review and adjust: Regularly review your financial plan and make adjustments as needed. Life circumstances and goals change over time, so it’s essential to reassess your financial strategies periodically.

By implementing these budgeting essentials and focusing on long-term financial planning, you can successfully adjust your lifestyle to a 50K salary. Remember, small changes and consistent effort can lead to significant financial progress.

Increasing Your Hourly Worth

When aiming to increase your hourly worth, there are various strategies you can employ to boost your earnings. By focusing on upskilling and education and negotiating for higher pay, you can elevate your earning potential significantly.

Upskilling And Education

Investing in further education and training can open doors to higher-paying opportunities.

- Enroll in online courses

- Attend workshops and seminars

- Obtain relevant certifications

Negotiating For Higher Pay

Advocating for your worth through negotiation can lead to increased earnings.

- Highlight your accomplishments

- Research industry standards

- Confidently make your case

Credit: www.titlemax.com

Exploring Additional Income Streams

Seeking ways to boost your yearly income can provide financial security and freedom. By exploring different avenues to earn extra money, you can achieve your financial goals faster.

Side Hustles

Consider taking on side gigs or freelance work to supplement your annual earnings. This can help you increase your hourly income and build valuable skills.

Passive Income

Invest in sources of passive income like rental properties or dividend-paying stocks. This can generate extra money with minimal effort on your part.

Investing For Financial Growth

Allocate a portion of your income to investments that offer long-term growth potential. This can help you build wealth over time and secure your financial future.

Frequently Asked Questions

What Is The Hourly Rate For A $50,000 Salary?

The hourly rate for a $50,000 salary is approximately $24. 04 per hour. This is calculated based on a standard 40-hour workweek over the course of a year.

Is A $50k Salary Considered Good Income?

A $50,000 salary can be considered a decent income, depending on the cost of living in your area. It falls around the median household income in the United States and can provide a comfortable lifestyle with proper budgeting.

How Can I Calculate My Hourly Wage From An Annual Salary?

To calculate your hourly wage from an annual salary, divide your total annual salary by the number of hours you work in a year. For example, if you work 40 hours per week for 52 weeks, you would divide your salary by 2080 hours.

Conclusion

Understanding how much $50,000 a year is hourly can provide valuable insights into budgeting and financial planning. It allows for better decision-making and empowers individuals to make informed choices about their income and expenses. By breaking down the annual salary into hourly earnings, individuals can gain a clearer perspective on their financial situation.

This knowledge can ultimately contribute to greater financial stability and security.